The Hindu Editorial Analysis

31 May 2025

Steep decline: Rural consumption remains poor despite the lowering of inflation

(Source – The Hindu, National Edition – Page No. – 08)

Topic: GS 3: Indian Economy | Industrial Growth | Inflation Trends | Rural Consumption and Agricultural Policy

Context

- India’s Index of Industrial Production (IIP) slowed to an eight-month low of 2.7% in April, signalling persistent economic weakness, especially in rural consumption.

- The core sector output also shrank to 0.5%, marking a significant drop from the 6.9% growth in April 2024.

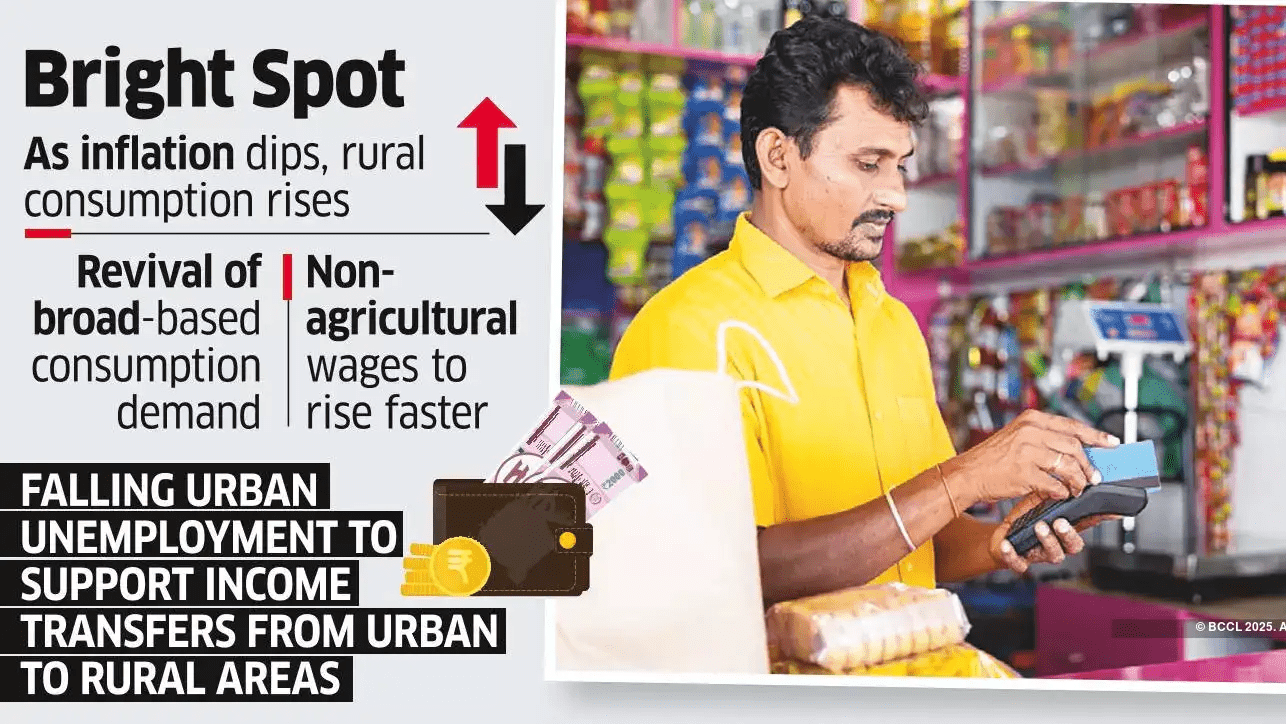

- While inflation has eased, rural non-durable consumption remains weak, undermining overall demand.

Introduction

Falling inflation has not lifted rural fortunes.

India’s slowing industrial output is not just a statistical dip, but a reflection of waning consumption, export uncertainty, and policy inertia in rural demand revival.

Key Data: Industrial and Core Sector Slowdown

1. IIP at 2.7%

- This is the lowest in 8 months, down from 5.2% in March.

- Manufacturing and power grew only 3.4% and 1.1%, a sharp fall from the 4.2% and 10.2% in March.

2. Core Sector Collapse

- The eight core industries (coal, crude oil, natural gas, refinery products, fertilizers, steel, cement, electricity) rose only 0.5% in April.

- This sector represents 40% of the IIP, so its weak showing is a major red flag.

The Bigger Concern: Rural Non-Durables Demand

1. Non-Durables in Decline for 3 Months

- Categories like food, soaps, household goods—core to rural consumption—have shrunk.

- Food inflation fell to 2.14%, but prices for farm produce dipped below MSP levels, dampening rural incomes.

2. Disconnect Between Inflation and Spending

- Even as retail inflation eased to 3.16%, there has been no uptick in rural demand.

- This suggests that low inflation alone does not ensure higher consumption, unless accompanied by income support or agricultural price reforms.

External Headwinds: Trade and Tariff Volatility

1. Mining Exports Down

- Exports from the mining sector (e.g., iron ore, bauxite) fell from $42 billion to $25 billion in a decade.

- Their share in total exports fell from 8.1% to 5.1%, hitting industrial output.

2. Global Risk and Overdependence on the U.S.

- With geopolitical tensions and tariff unpredictability, India must diversify exports and reduce U.S. dependence.

- Export performance remains erratic, further pressuring industrial growth.

What Should Be Done

1. Raise Rural Incomes

- Government must increase MSP coverage and procurement in a targeted, region-specific manner.

- More cash in the hands of rural consumers will boost demand for non-durables.

2. Stimulate Private Investment in Exports

- Reduce policy uncertainty, incentivize private exporters, and expand into newer markets.

3. Prioritize Food Supply Chain Reforms

- Build rural infrastructure to store, process, and transport perishables efficiently, reducing losses and raising farmer returns.

Conclusion

Industrial recovery is impossible without reviving rural consumption.

Inflation control is a milestone, not the goal—without purchasing power in the hands of the poor, economic growth remains skewed and unsustainable.

India must now transition from price stability to demand generation, especially in non-urban, agriculture-dependent regions—or risk prolonging its industrial slowdown.