The Hindu Editorial Analysis

22 December 2025

Unlocking the potential of India-Africa economic ties

(Source – The Hindu, International Edition – Page No. – 8)

Topic : GS 2: India and its neighborhood- relations

Context

India’s engagement with the continent must shift from short-term interactions to the creation of durable, long-term, and sustainable partnerships.

Introduction

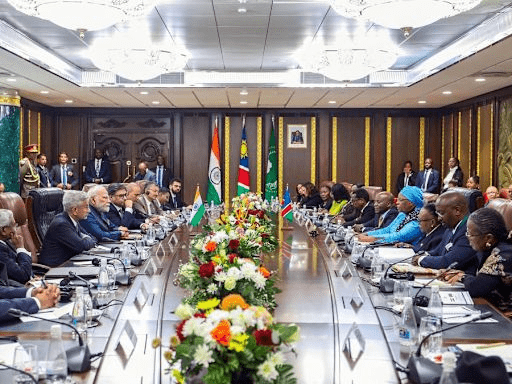

Prime Minister Narendra Modi’s July 2025 visits to **Namibia and Ghana, along with Trinidad and Tobago, Argentina, and Brazil, renewed focus on India–Africa economic ties, echoing his December 2025 visit to Ethiopia. Over the past decade, relations have gained fresh momentum, marked by the African Union becoming a permanent member of the G20 in 2023. While rooted in cultural affinity and political solidarity, the partnership is now increasingly economics-driven.

Uncertainties in Western Markets

- In FY24, nearly 40% of India’s exports were directed to the United States and the European Union, exposing India to rising volatility and slowdown risks in these economies.

- Growing policy uncertainty, trade protectionism, and demand fluctuations in Western markets underline the need for export diversification.

- African economies offer an important alternative growth avenue, with expanding markets and long-term demand potential.

India–Africa Trade Dynamics and Strategic Imperatives

- India is Africa’s fourth-largest trading partner, with bilateral trade nearing $100 billion; exports in FY24 stood at $38.17 billion, led by Nigeria, South Africa, and Tanzania.

- Key Indian exports include petroleum products, engineering goods, pharmaceuticals, rice, and textiles, accounting for about 6% of Africa’s total imports in 2024.

- In comparison, China dominates Africa’s trade with over $200 billion in bilateral commerce, supplying 21% of Africa’s imports, largely in HSN 84 and 85 categories such as machinery, electrical equipment, and semiconductors.

- To bridge this gap, India has set a goal to double trade with Africa by 2030, beginning with reducing trade barriers and negotiating preferential trade agreements and comprehensive economic partnerships with African regional blocs.

- A critical shift is needed from low-value exports to value-added manufacturing, joint ventures, and cross-border production, while leveraging platforms like the African Continental Free Trade Area to access larger integrated markets and support a new phase of India–Africa economic engagement.

An opportunity for MSMEs

- Expanding Lines of Credit and improving access to trade finance should be prioritised, as African markets are more accessible for MSMEs than the highly competitive U.S. and European markets.

- Despite strong potential, there is a policy gap in supporting MSMEs to enter and scale operations across African economies.

- Affordable trade finance is vital for a sustainable partnership, complemented by local currency trade and a joint insurance pool to mitigate political and commercial risks, encouraging banks and smaller firms to participate.

- Reducing logistics and freight costs through port modernisation, better hinterland connectivity, and stronger India–Africa maritime corridors can significantly enhance MSME competitiveness.

- Scaling up services trade, digital commerce, and people-to-people links—leveraging India’s strengths in IT, healthcare, professional services, and skill development—can generate high-value exports and catalyse broader two-way trade, an area where current policies remain inadequate.

A role for the Indian public sector

- Stepping up investments by Indian firms in manufacturing, agro-processing, infrastructure, renewable energy, and critical & emerging technologies can significantly deepen India’s engagement with African economies.

- India’s current investment footprint in Africa is distorted by flows via Mauritius, often driven by tax-avoidance motives, rather than genuine productive investment on the continent.

- Bureaucratic delays, political instability, and high financing costs continue to deter Indian private firms from expanding in Africa.

- Public Sector Units (PSUs) must therefore take a leadership role, especially in mining and mineral exploration, to secure critical resources, reduce risk perceptions, and crowd in private investment.

Conclusion

Ultimately, India’s engagement with Africa must transcend transactional trade and evolve into long-term, sustainable partnerships. As global supply chains are reconfigured and the world moves towards a multipolar economic order, Africa will be central to India’s global economic ambitions. This is a critical moment for India to recalibrate strategies, innovate policy approaches, and deepen its economic footprint across the African continent.